how are property taxes calculated in pasco county florida

ALL RIGHTS RESERVED DIGITAL LIGHTBRIDGE. Electronic Property Tax Notice Receipts.

301 Highway Dade City Fl 33525 Compass

During the month of October the Florida Breast Cancer Foundation will be the featured charitable giving organization at the Pasco County Tax Collectors Office.

. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account. The Florida Breast Cancer. Money from property tax payments is the cornerstone of local neighborhood budgets.

My team and I are committed to exceptional service fairness and accuracy. Pasco County provides taxpayers with a variety of tax exemptions that may lower propertys tax bill. Thank you for visiting your Pasco County Property Appraiser online.

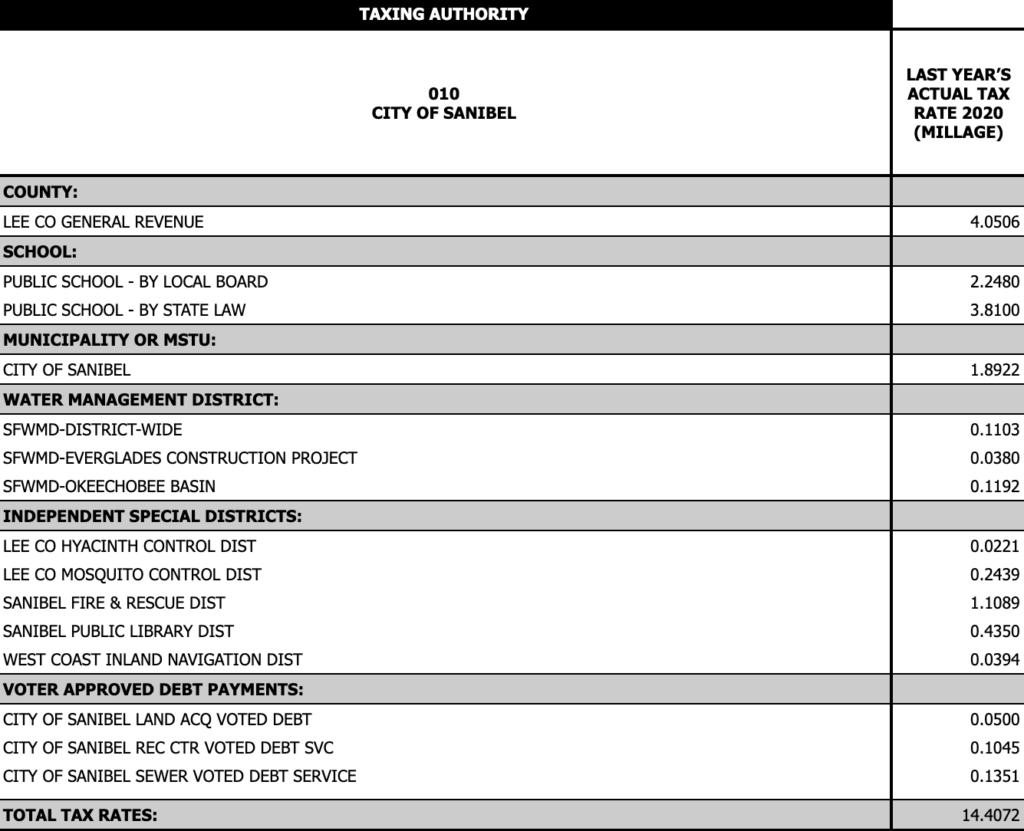

Pasco County collects on average 087 of a propertys assessed fair. Along with Pasco County they rely on real property tax receipts to support their operations. Please note that we can.

How do I print my real estateproperty. This simple equation illustrates how to calculate your property taxes. SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes.

Change My Property Tax Mailing Address. These are deducted from the assessed value to give the propertys taxable. Choose Your Legal Category.

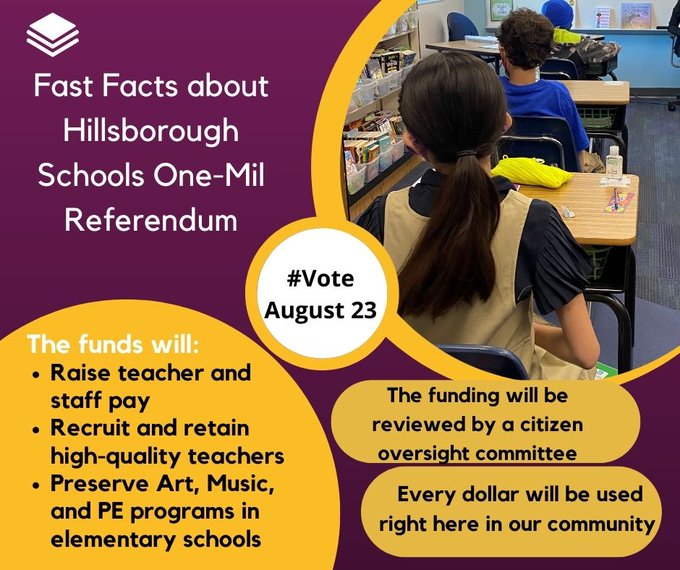

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Search all services we offer. Pasco County residents will decide whether or not to approve this increase on Aug.

The median property tax also known as real estate tax in Pasco County is 136300 per year based on a median home value of 15740000 and a median effective property tax rate of. Business Tax Receipt Information. If passed the ballot initiative would increase Pasco County residents property taxes by 1.

The Pasco County Tax Collectors Office located in Dade Florida is responsible for financial transactions including issuing Pasco County tax bills collecting personal and real property tax. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax. The median property tax in Pasco County Florida is 1363 per year for a home worth the median value of 157400.

Cost Of Living In Tampa Bay Florida

Home Pasco County Property Appraiser

Pasco County Fl Newest Real Estate Listings Zillow

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Florida Property Taxes Explained

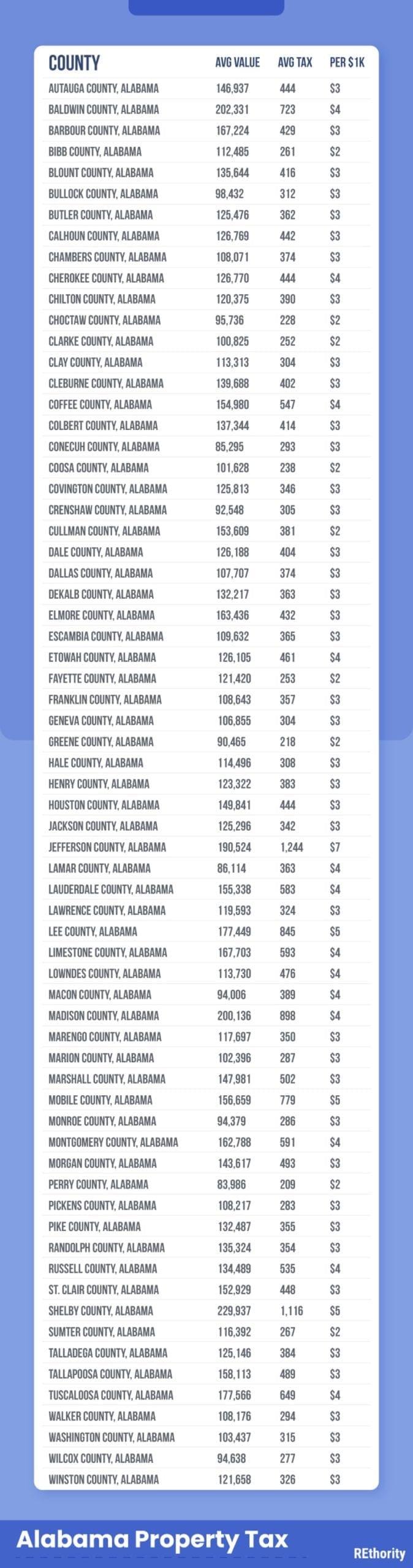

Property Tax By County Property Tax Calculator Rethority

Florida Real Estate Taxes Echo Fine Properties

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

Property Taxes Polk County Tax Collector

Florida Sales Tax Calculator Reverse Sales Dremployee

Petition Lower St Lucie County S Highest In The State Of Florida Property Tax Millage Rate Change Org

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

How Is The Property Tax Calculated In Florida Quora

Pasco County Fl Property Tax Search And Records Propertyshark

Home Pasco County Property Appraiser